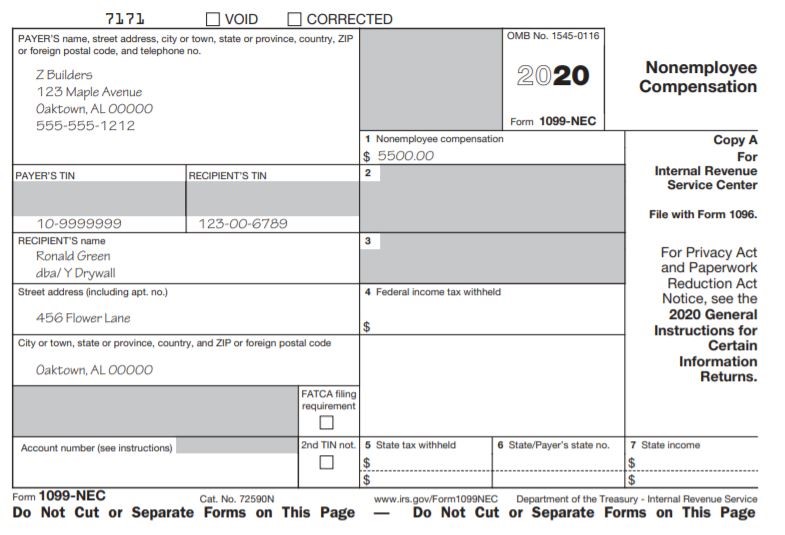

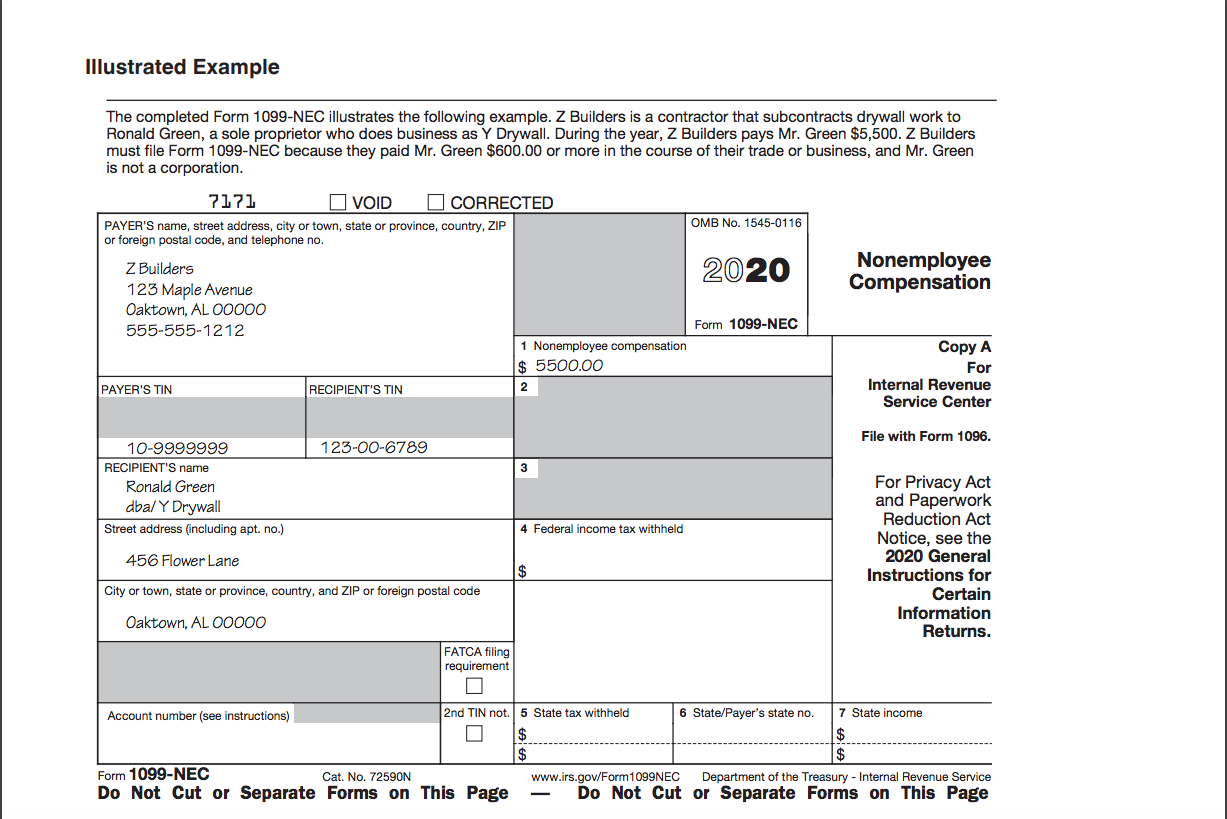

I have the exact same problem with the form 1099NEC link to schedule C It is stuck in a loop that will not let me file I have two 1099NEC Linked only to schedule C and not scedule F yet it says I have multiple links forIRS Form 1099NEC Get Printable Sample and Fill Online The IRS uses Form 1099NEC to communicate with taxpayers regarding nonemployee compensation It is used as the primary document to report NonEmployee Compensation to the IRS Form 1099NEC is mailed and filed with the IRS to report the payment of nonemployment compensation to a NonEmployee On Form 10990707 · On July 6, , the IRS issued Tax Tip 80 to remind business taxpayers that, commencing with payments made in , they must report

1099 Nec And 1099 Misc Changes And Requirements For Property Management

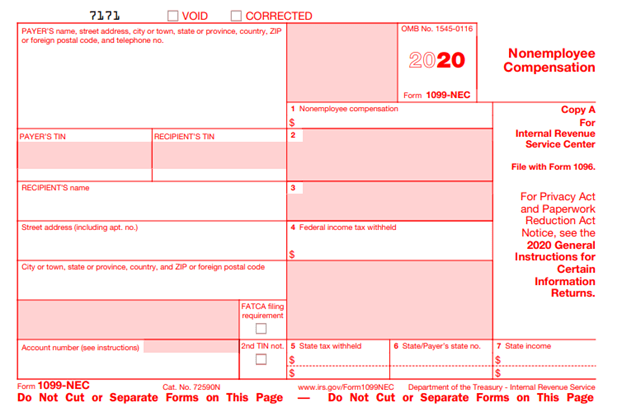

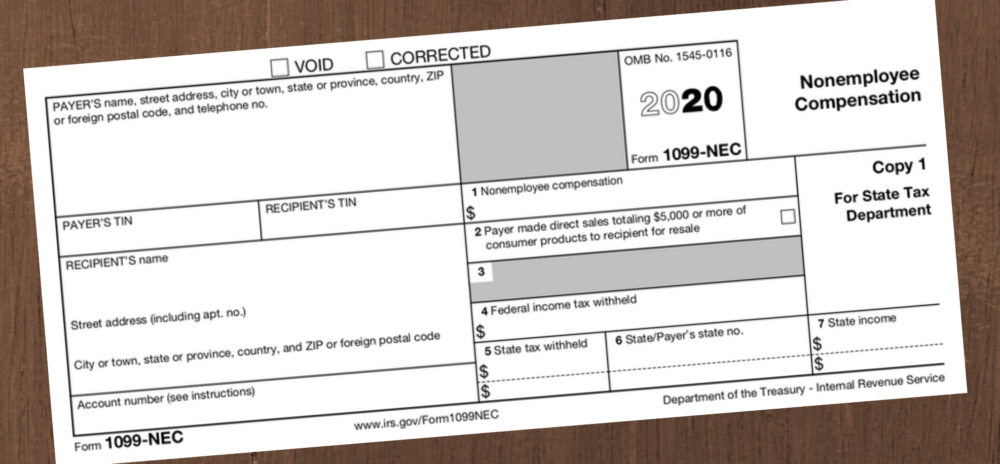

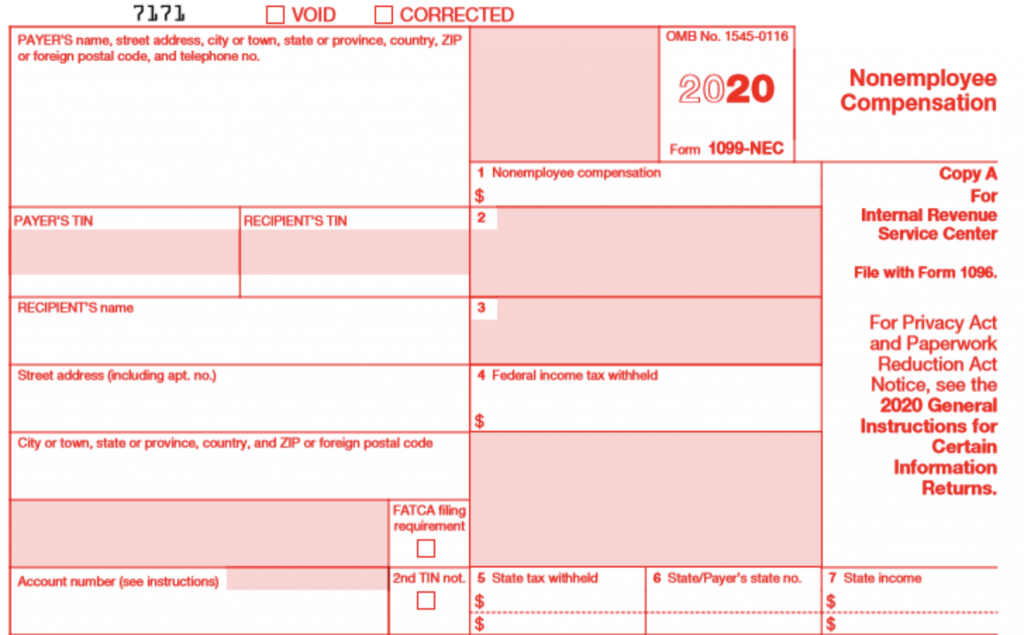

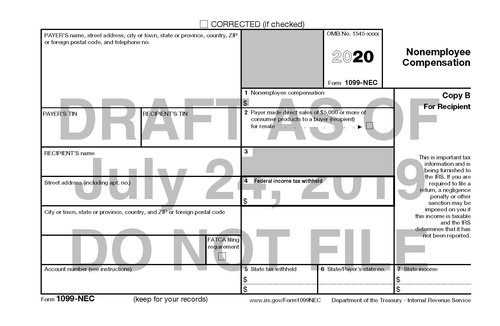

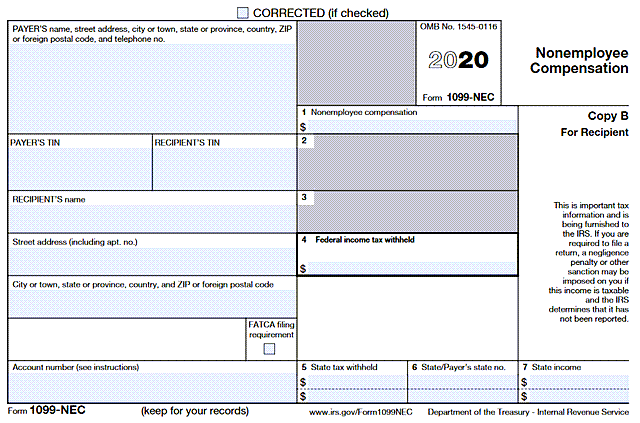

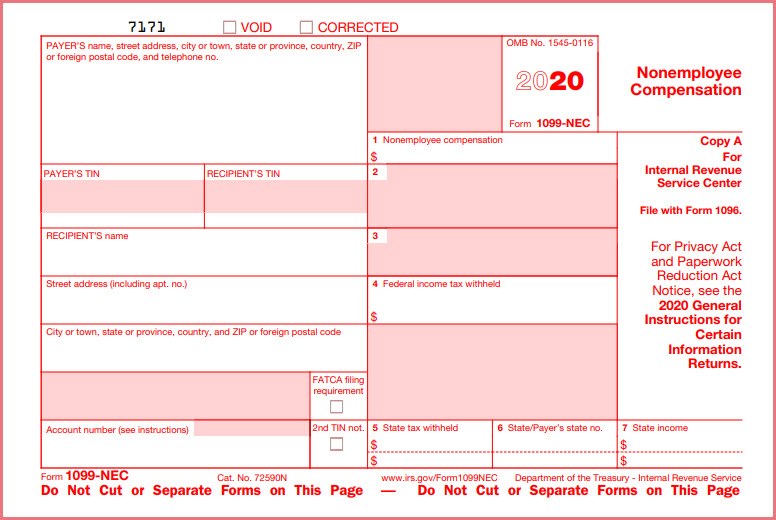

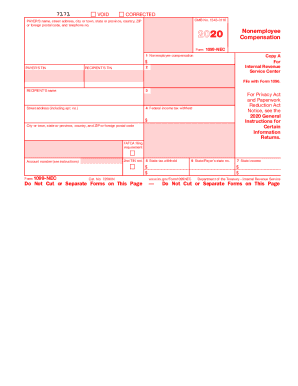

1099 nonemployee compensation 2020 form

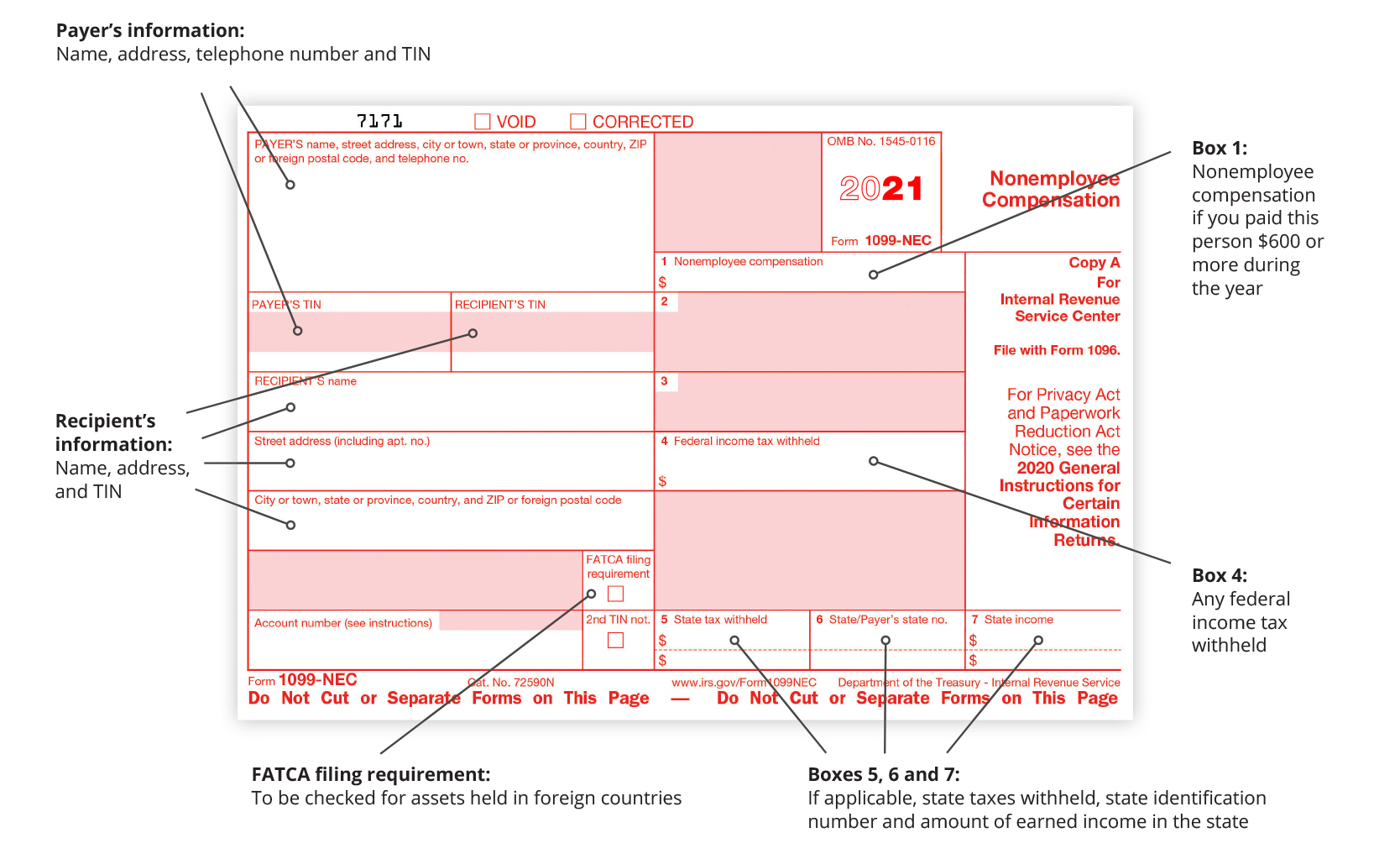

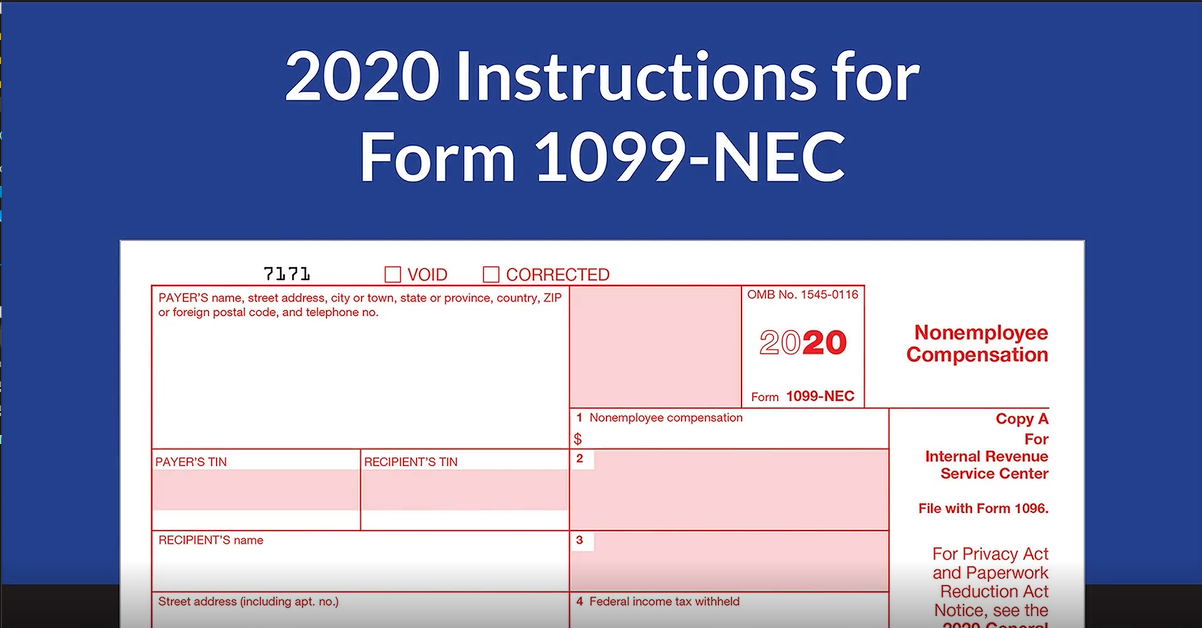

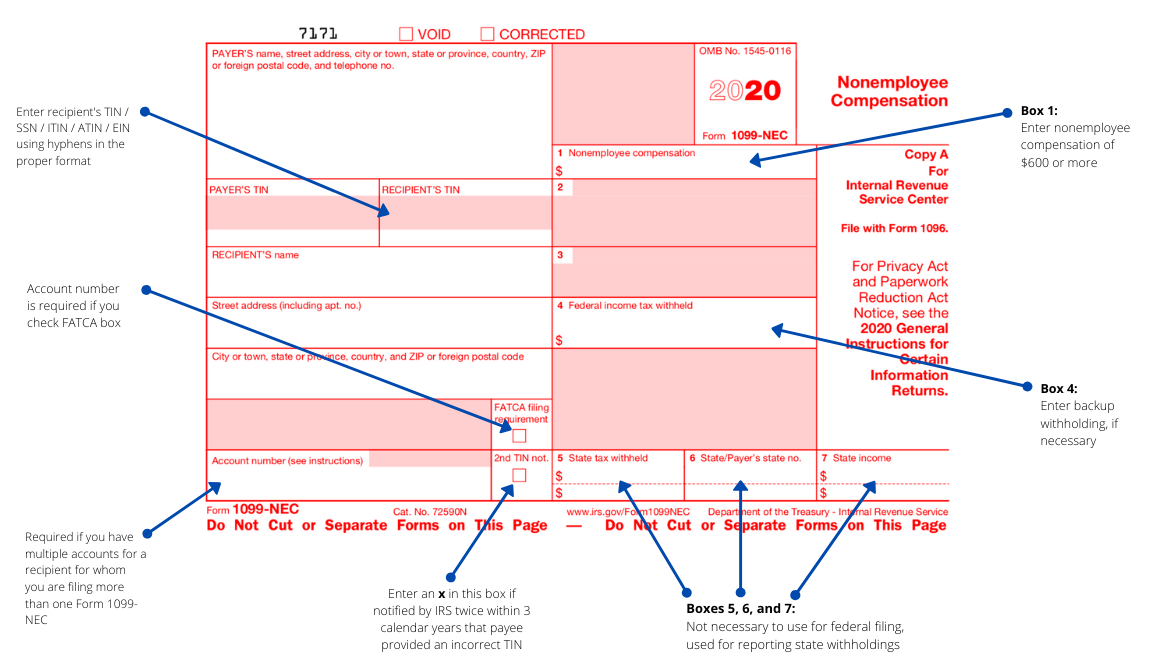

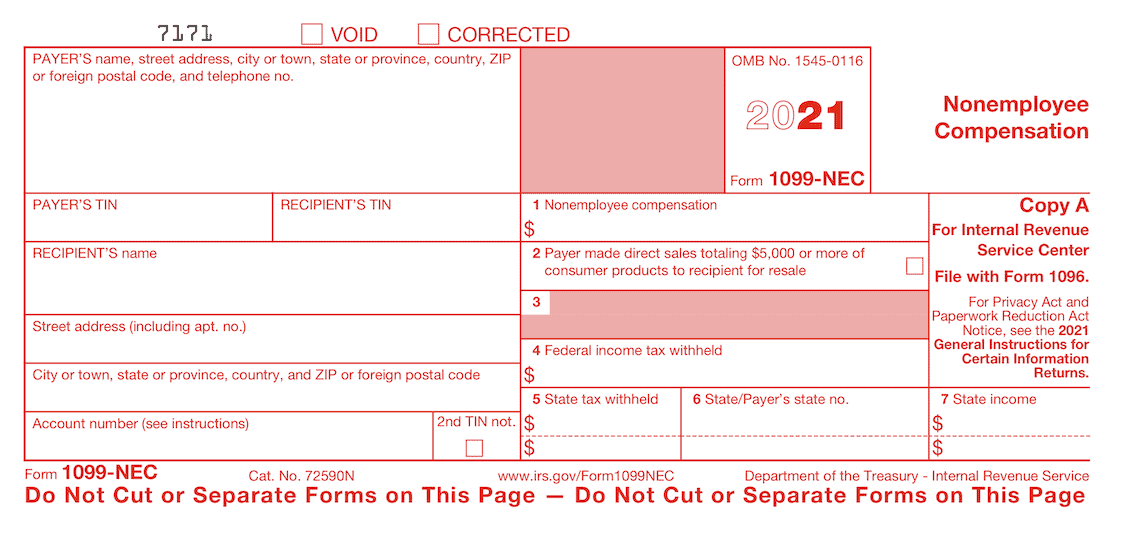

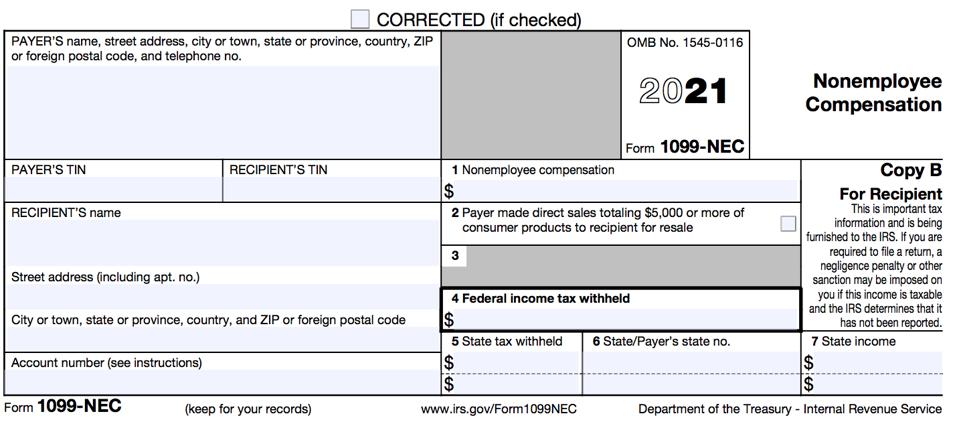

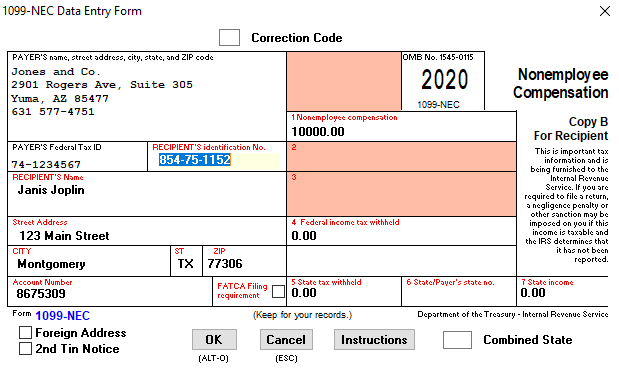

1099 nonemployee compensation 2020 form-1609 · Sep 16, The IRS has released form 1099NEC (NonEmployee Compensation) for reporting money a business pays to independent contractors This new form will replace box 7 on the 1099MISC formBeginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISC Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor If you are selfemployed,

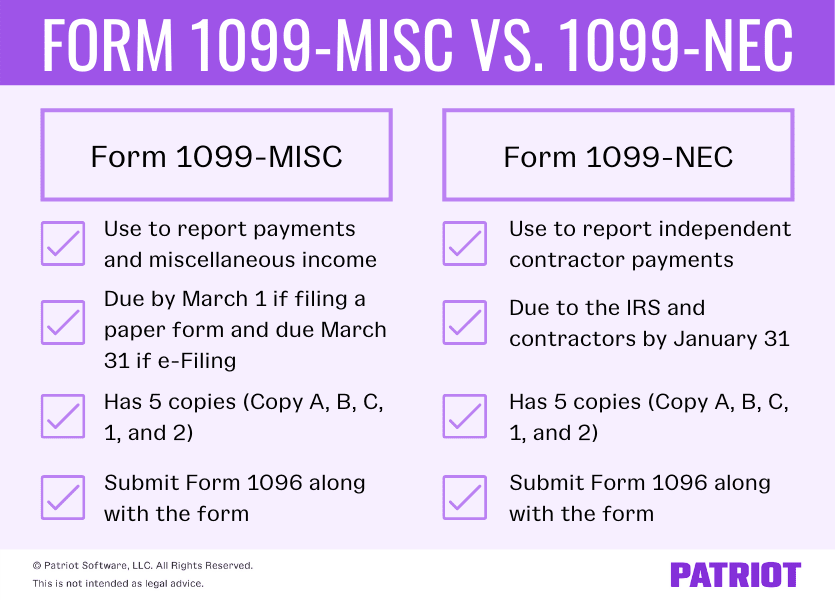

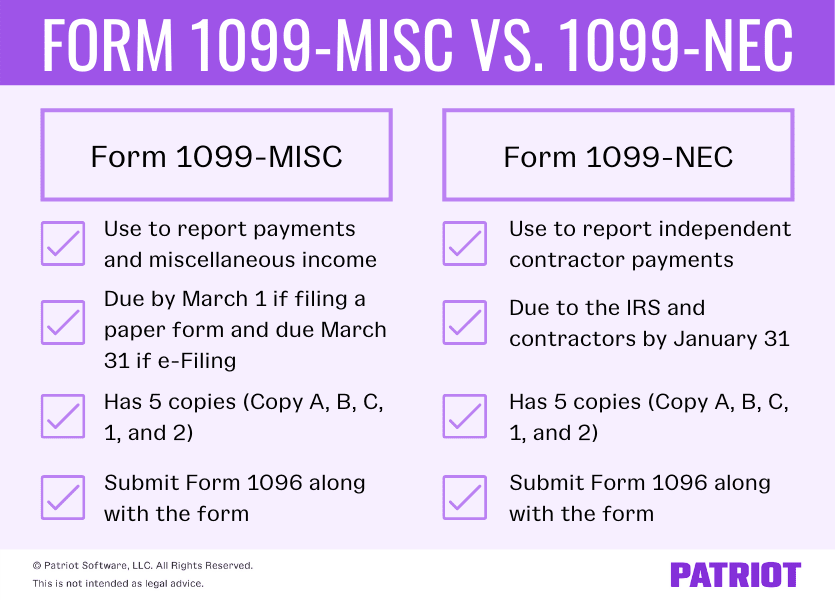

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

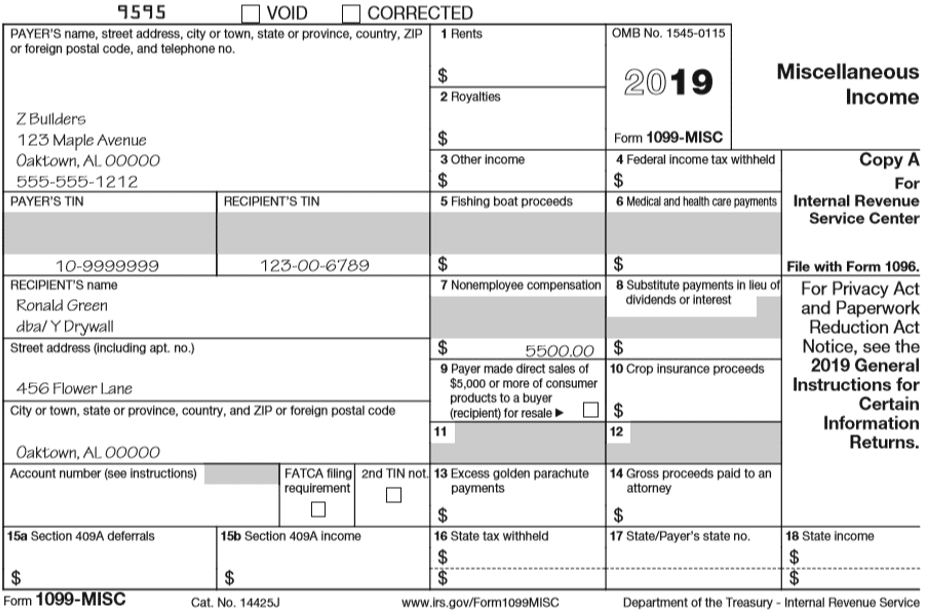

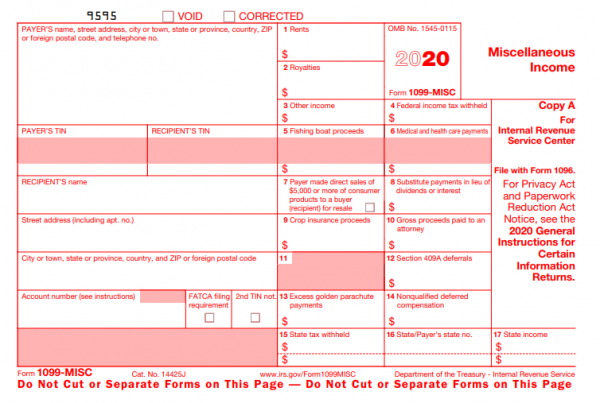

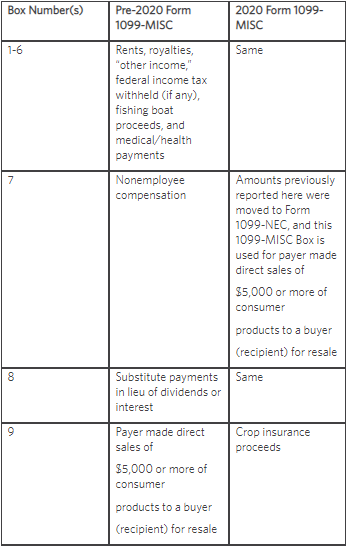

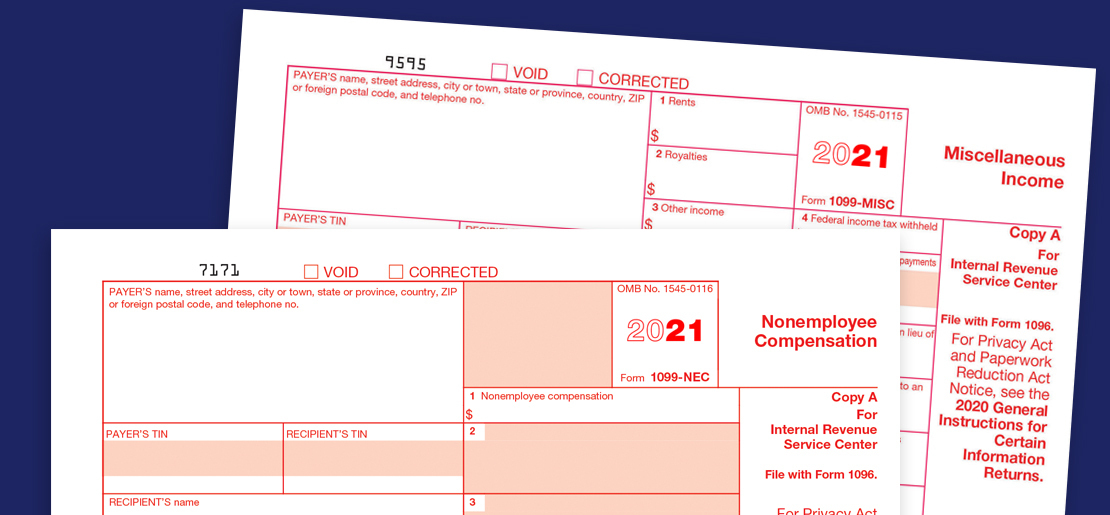

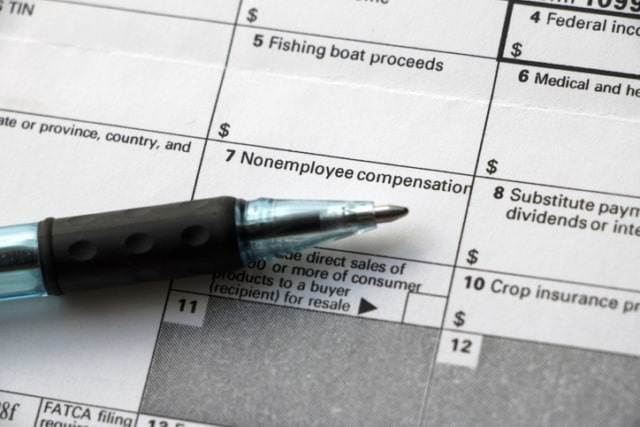

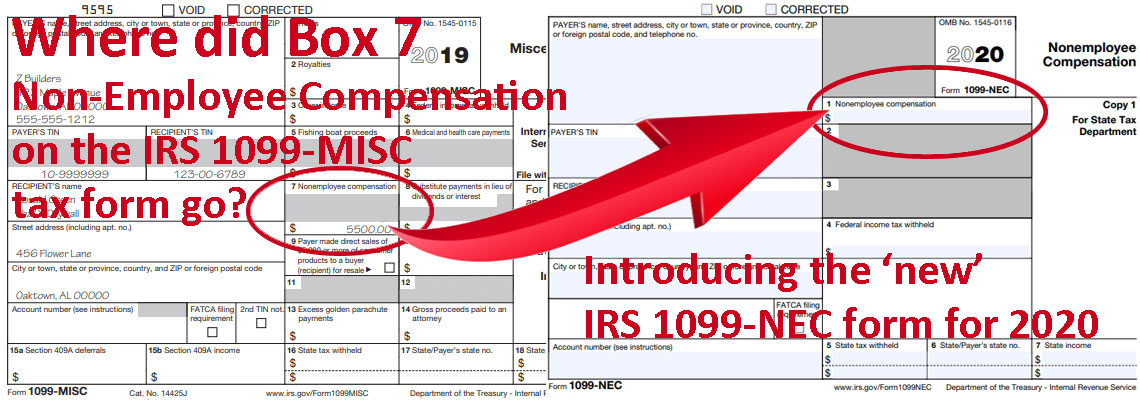

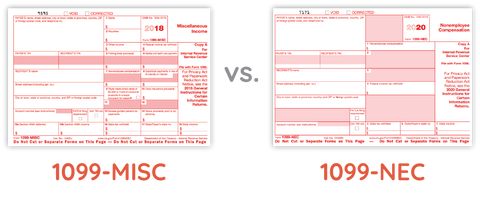

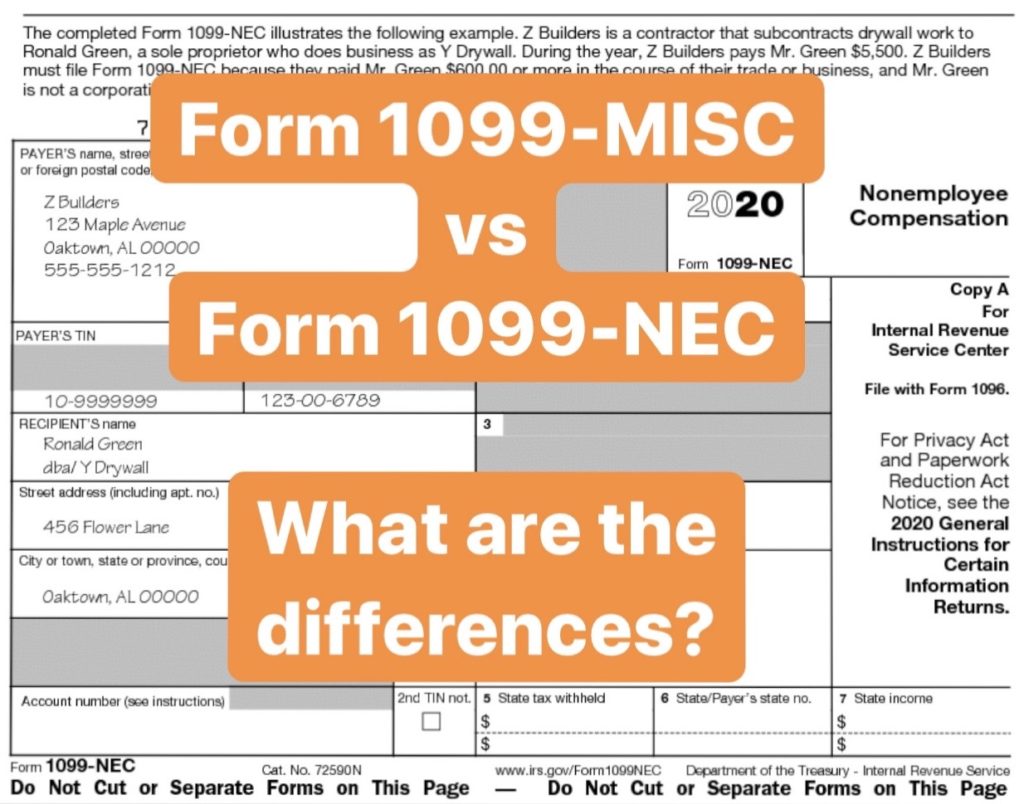

0500 · 1099MISC reported nonemployee compensation in Box 7 for over thirty years Then, in July of 19, the IRS announced Box 7's reassignment to direct sales and the reinstatement of Form 1099NEC The first year Form 1099NEC is required is 21 for payments made in2511 · Updated on November 25, 1030 AM by Admin, ExpressEfile Team The IRS has introduced Form 1099NEC again, after 19, in order to avoid the confusion in deadlines for filing Form 1099MISC Form 1099NEC must be filed to report nonemployee compensation paid in a year, which has been reported in Box 7 of 1099MISC0121 · 1099NEC replaces 1099MISC box 7 for nonemployee compensation for Where do you input 1099NEC info in TurboTax I can't find it You will have to wait for the updates for Schedule C for business income in January Those new forms have not been updated yet

3011 · 1099NEC NEW Nonemployee Compensation Reporting for 1099NEC NEW Nonemployee Compensation Reporting for Watch later Share Copy link Info Shopping Tap to unmute If · Reading Time 3 minutes After a 38year absence, Form 1099NEC has made its return in the tax year, and its January 31 deadlines are right around the corner Don't panic – here's everything you need to know about the revived form, and how it is intended to be used For the last few decades, business owners were responsible for using Form 1099MISC to report nonemployee compensationReport your Form 1099 NEC in secure & fast way with Form1099Online Here you can know What are the Requirements for Filing 1099 NonEmployee Compensation with awesome features Deadline for 1099 Nec is 31st of every year Form 1099

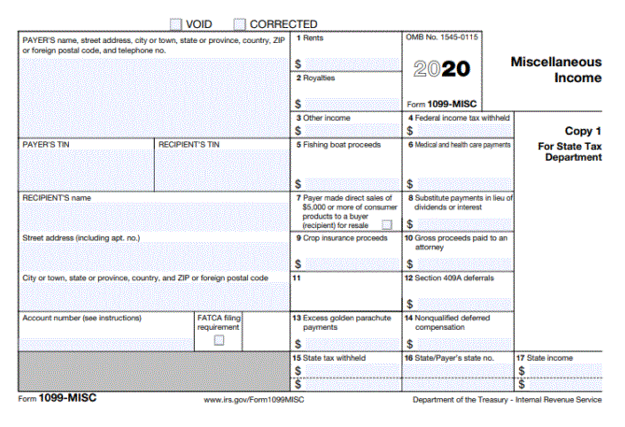

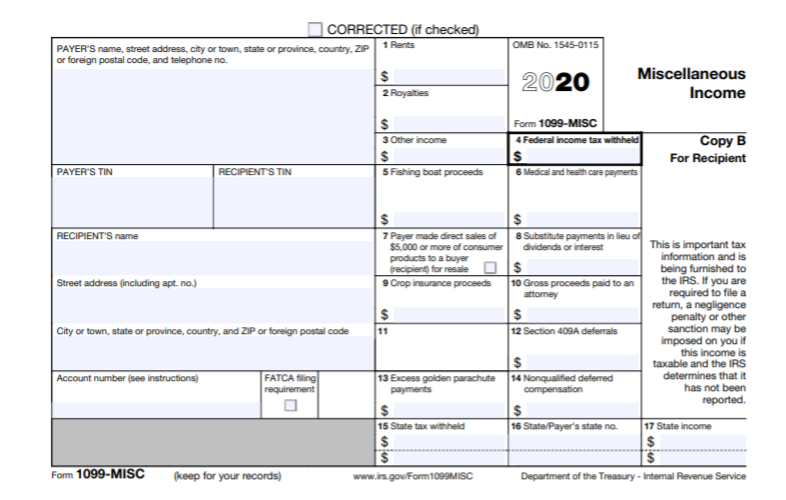

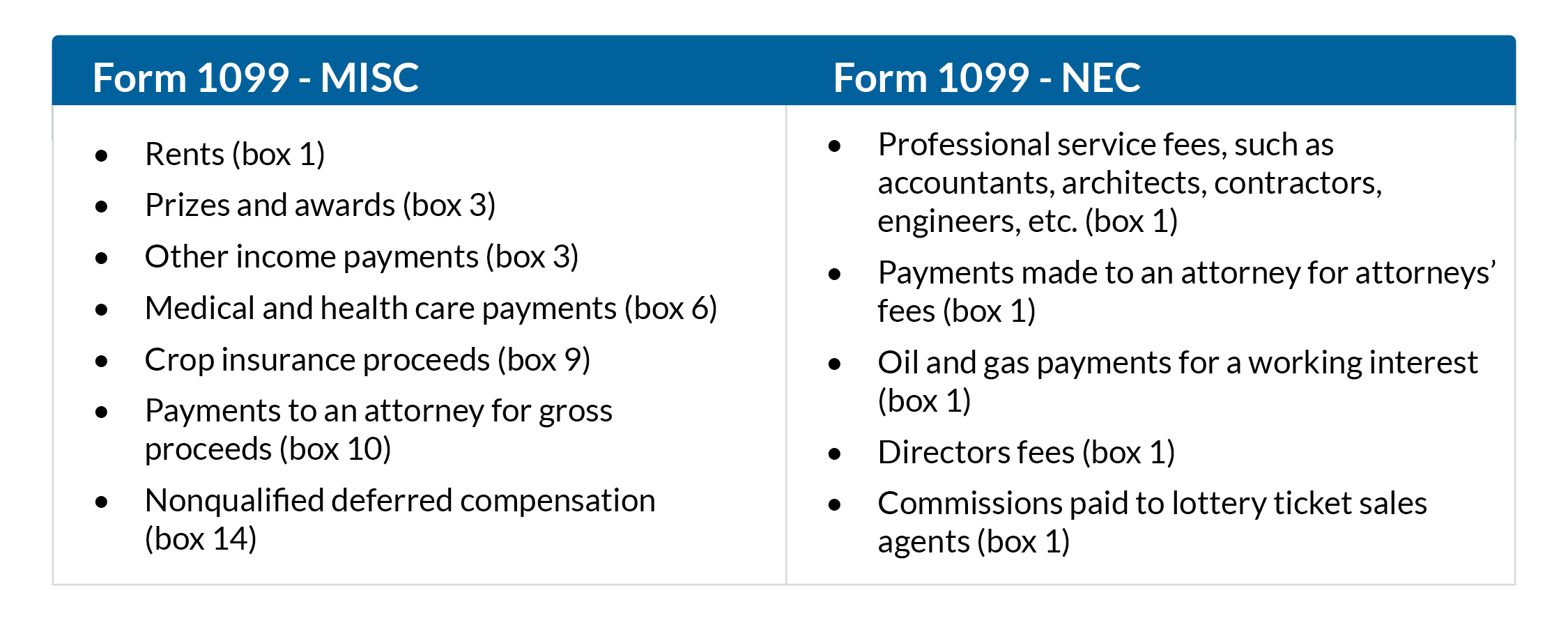

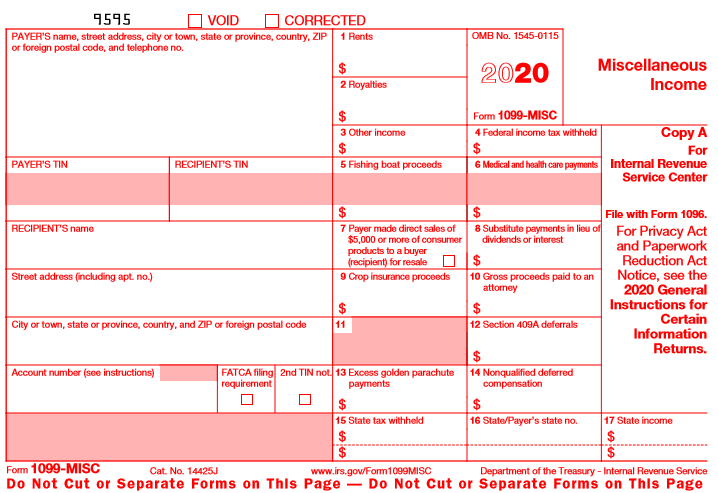

0421 · A business will only use a Form 1099NEC if it is reporting nonemployee compensation If a business needs to report other income, such as rents, royalties, prizes, or awards paid to third parties,Form 1099NEC Nonemployee Compensation Worksheet Double click to link to Schedule C I have no idea what this is or how to move past the issue What does it want? · Follow these steps Open TurboTax On the top right corner of TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner) Type in "1099NEC" (or for CD/downloaded TurboTax, click Find), Click on the "Jump to 1099NEC" link

Acumatica 1099 Nec Reporting Changes Crestwood Associates

Nonemployee Compensation Form 1099 Due Dates Wichita Cpa Firm

The IRS has separated nonemployee compensation onto a new form called the 1099NEC for tax year Because of this, the IRS has revised Form 1099MISC and rearranged box numbers for reporting certain income If you have other questions about 1099s, see what is a 1099 and do I need to file one?Starting , nonemployee compensation should be reflected on form 1099NEC instead of 1099MISC Use form 1099MISC to report rents, other income, royalti1709 · Nonemployee compensation was previously included on the 1099MISC form Article Sources Internal Revenue Service "Form 1099NEC Prior Year Products" Accessed Sept 2, Internal Revenue Service " Instructions for Forms 099MISC and 1099NEC," Page 10 Accessed Sept 2, Internal Revenue Service " instructions for Forms 099MISC and 1099

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

0221 · If you received the Form 1099NEC for a nonemployee compensation, you should enter the information in both Form 1099NEC and Schedule C sections I will suggest you to add the Schedule C See below for instructions You would start from the 1099NEC section under "1099MISC and Other Common Income"1812 · Starting in the tax year , all nonemployee compensation (NEC) payments should be reported on the new 1099NEC form Any money paid to freelancers, independent contractors, "gig workers," and other nonemployees should be reported in Box 1 of this form2311 · Nonemployee compensation for years has been reportable on line 7 of Form 1099MISC, but beginning with forms, filers instead will report nonemployee compensation on Form 1099NEC This change, we are told, is designed to "increase compliance"

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

Irs Tax Form 1099 Nec What It Is And What You Need To Know To Use It Blog For Accounting Quickbooks Tips Peak Advisers Denver

· Nonemployee compensation is the income paid by companies that classify an individual as a nonemployee Nonemployee compensation can represent a variety of business payments including fees, commissions, prizes or rewards The IRS and states use a variety of information returns to verify the accuracy of income claimed by individuals and business taxpayers including Form 1099Beginning in the tax year, Form 1099NEC is the Internal Revenue Service (IRS)form used by businesses to report payments made to independent1811 · Starting in tax year , Form 1099NEC will be used to report compensation totaling more than $600 (per year) paid to a nonemployee for certain services performed for your business Previously, business owners would file Form 1099MISC to report nonemployee compensation (in box 7) Now, this compensation is to be listed in Box 1 on the 1099NEC It should be noted that Form 1099

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

Irs Form 1099 Nec Non Employee Compensation

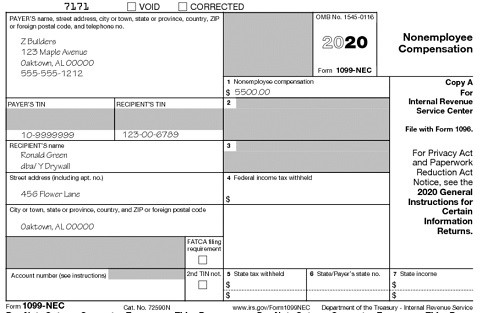

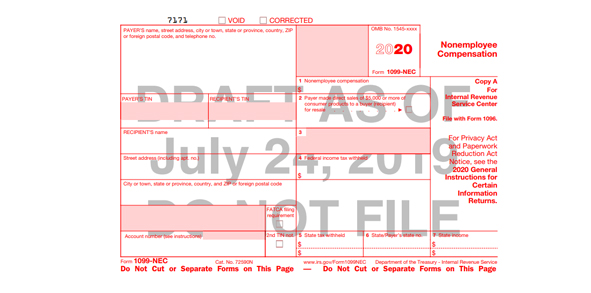

1502 · Form 1099NEC essentially replaces box 7 (labeled nonemployee compensation) on form 1099MISC Subsequently, box 7 on form 1099MISC for tax year has been removed Actually, this new form was an old form that has not been in use since 19 Because there were separate filling dates for box 7 on the 1099MISC and the other types of compensation reported on form 10991099NEC Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the General Instructions for Certain Information Returns 7171 VOID CORRECTED1111 · If an individual is paid $600 or higher in nonemployee compensation, they will be issued a 1099NEC for incomeThe IRS has reissued the form 1099NEC for the tax season to replace box 7 on the 1099MISC, which up until recently was standard for reporting nonemployee paymentsAny income appearing in box 7 of a 1099MISC prior to is

Tax Updates Form 1099 Atlanta Tax Cpas

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

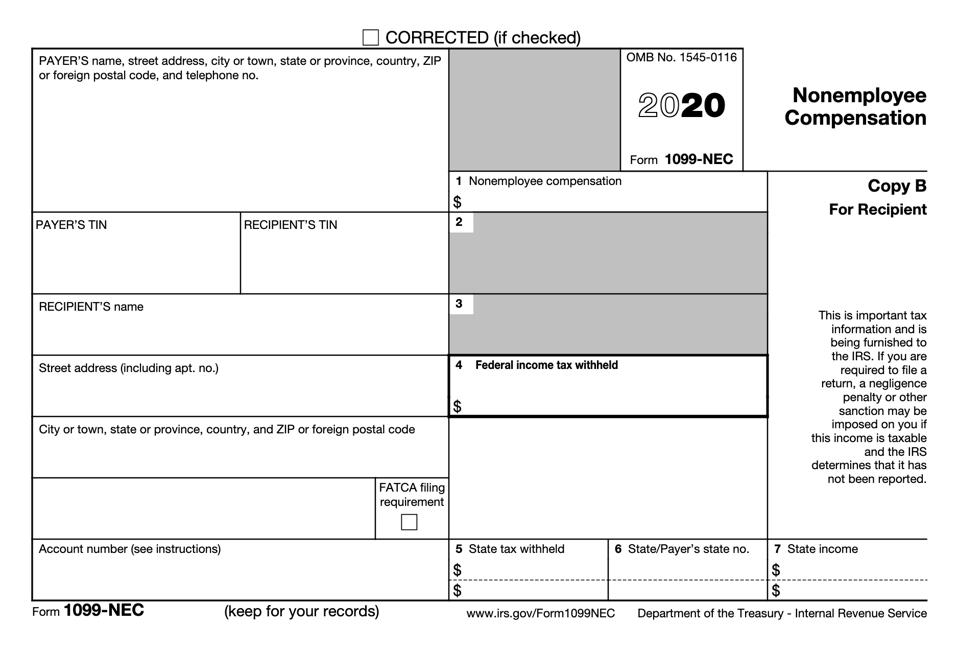

Nonemployee compensation $ 2 Payer made direct sales totaling $5,000 or more of consumer products to recipient for resale 3 4 Federal income tax withheld $ 5 State tax withheld $ $ 6 State/Payer's state no 7 State income $ Form 1099NEC wwwirsgov/Form1099NEC Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page2221 · Use Form 1099NEC to report nonemployee compensation Current Revision Form 1099NEC PDF Current Revision Form 1099NEC PDF Information about Form 1099NEC, Nonemployee Compensation, including recent updates,The short answer to keep nonemployee expenses separate from Form 1099MISC and clear up some confusion with due

1099 Sample Forms

Self Employed Vita Resources For Volunteers

· What's new for tax year ?2912 · New IRS Form 1099NEC for NonEmployee Compensation, Including Directors' Fees Sep 9, Share ' New IRS Form 1099NEC for NonEmployee Compensation, Including Directors' Fees ' was added to your binder Remove View my binder now Add to Binder Executive Compensation Blog Way back in 15, the Protecting Americans from Tax Hikes (PATH) Act of2112 · Beginning with the tax year, the IRS will require Form 1099NEC to be used exclusively to report nonemployee compensation if the payments to the nonemployee totaled $600 or more Businesses that historically reported payments in Box 7 of Form 1099MISC will now use the new Form 1099NEC The good ol' Form 1099MISC is still around but will only be used to

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

0505 · Form 1099NEC Reissue The nonemployee compensation Form 1099NEC isn't new—it's actually an old form that has not been used since 19 The IRS is bringing it out of retirement starting in to split nonemployee compensation up from miscellaneous incomeForm 1099NEC Nonemployee Compensation Since you were not an employee of the company or person who paid you, your payment (compensation) is reported on the 1099NEC instead of Form W2 Per IRS Instructions for Forms 1099MISC and 1099NEC Miscellaneous Information and Nonemployee Compensation, on page 100607 · There is a new Form 1099NEC, Nonemployee Compensation for business taxpayers who pay or receive nonemployee compensation Starting in tax year , payers must complete this form to report any payment of $600 or more to a payee Generally, payers must file Form 1099NEC by January 31 For tax returns, the due date is February 1, 21

How To Add 1099 Nec To Your Sage 100 Tax Forms

What S The New 1099 Nec For Non Employee Compensation

0412 · Here's your guide to the new IRS Form 1099NEC (NonEmployee Compensations) If you want to efile 1099NEC or looking for more information on how to efile 1099MISC form for 21, you can start by selecting the forms hereForm 1099NEC is replacing Form 1099MISC for nonemployee compensation reporting to the IRS for This brief video covers nonemployee compensation, which · Ordinarily 1099MISC box 7 nonemployee compensation is considered selfemployment income and entered on a schedule C However, the 1099MISC form instructions say 'If you are not an employee but the amount in this box is not SE income (for example, it is income from a sporadic activity or a hobby), report it on Form 1040, line 21

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

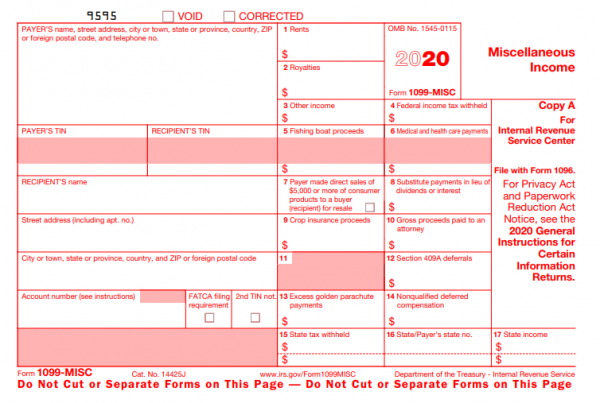

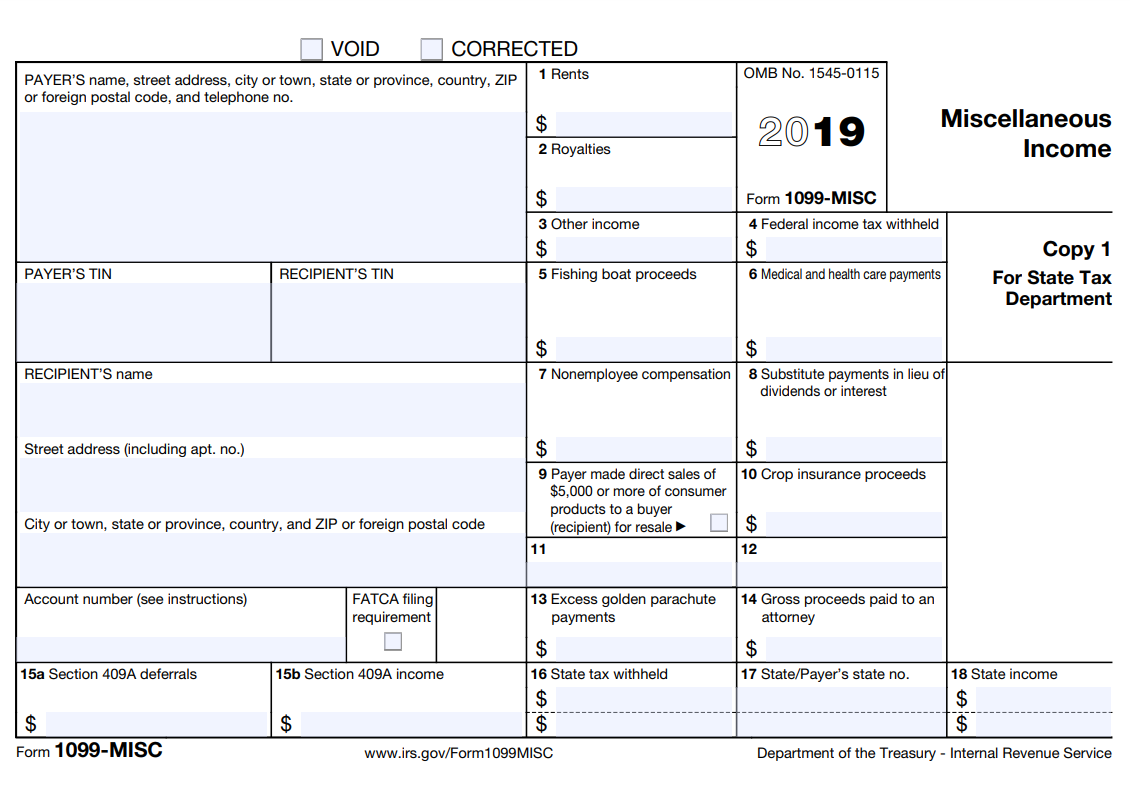

Form 1099 Misc Miscellaneous Income Definition

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

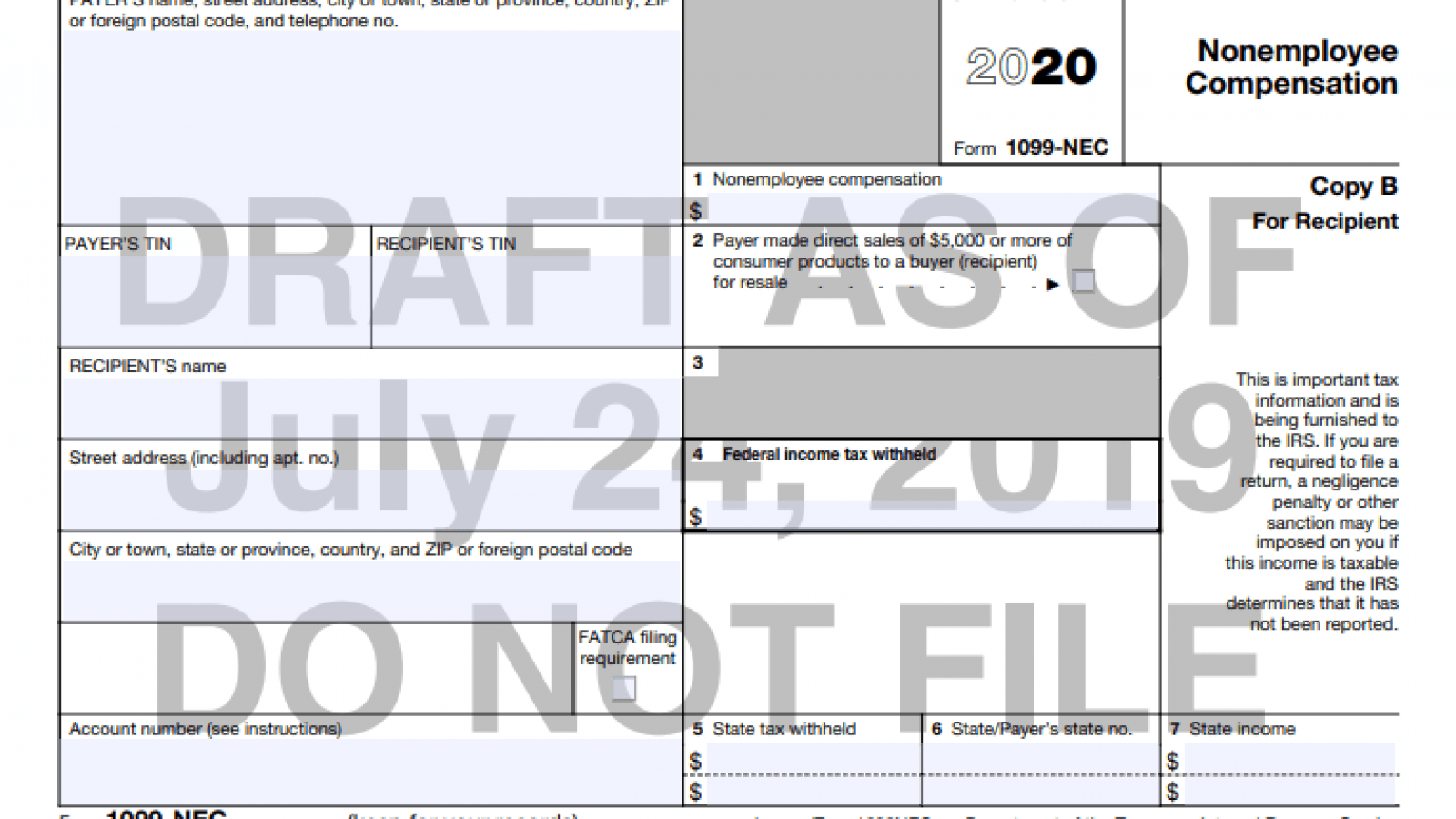

2611 · Suppose you are paying independent contractor nonemployee compensation, remember to separate nonemployee compensation payments from all your form 1099MISC payments From , fill form 1099 NEC if you have paid workers with $600 or more for nonemployee compensation Hope the information is clear about 1099 MISC and 1099 NEC The0112 · This year's Form 1099MISC reporting includes a major change that will impact most filers in some way For and years going forward, nonemployee compensation reporting has been removed from the Form 1099MISC and must be reported on the new Form 1099NEC Join us for a webcast addressing updated requirements, deadlines, and complications regarding stateThe IRS has recently released a draft of a new form, Form 1099NEC, which will be used to report payments for Nonemployee Compensation paid in Payments made prior to have previously been made using Form 1099MISC, box 7, Nonemployee Compensation (NEC)

Is Your Business Prepared For Form 1099 Changes Rkl Llp

What Is Form 1099 Nec Who Uses It What To Include More

1510 · Prior to tax year , nonemployee compensation was reported in Box 7 on Form 1099MISC However, with the passing of the Protecting Americans from Tax Hikes (PATH) Act in 15, the due date for reporting amounts in Box 7 was accelerated to Jan 31, while the deadline for reporting most other information on Form 1099MISC remained at Feb 28, if filing on paper, andThe PATH Act, PL , Div Q, sec 1, accelerated the due date for filing Form 1099 that includes nonemployee compensation (NEC) from February 28 to January 31 and eliminated the automatic 30day extension for forms that include NEC Beginning with tax year , use Form 1099NEC to report nonemployee compensation0812 · Plan for changes to Form 1099 filing for New deadlines, nonemployee compensation procedure 12/8/ Jimit Mehta, Susan Cooper With the passing of the Protecting Americans from Tax Hikes (PATH) Act of 15 , Congress changed the due date of "Nonemployee compensation" reported on Form 1099MISC, Box 7, to Jan 31

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

· Form 1099NEC did not replace Form 1099MISC It just took over the nonemployee compensation portion of 1099MISC Before the revival, Form 1099NEC was last used in 19 So, why did the IRS bring the 1099NEC form back in ? · What is Form 1099NEC Nonemployee Compensation?The IRS has released the Form 1099NEC that replaces Form 1099MISC for reporting nonemployee compensation (in Box 7) To use the "reinstated" 1099NEC

:strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 Nec A New Way To Report Non Employee Compensation Hlb Gross Collins

What Does The Revived Form 1099 Nec Entail For Taxpayers In Initor Global

Information Reporting Reminders Bkd Llp

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

1099 Nec Form Copy B 2 Discount Tax Forms

What Is Form 1099 Nec For Nonemployee Compensation

Form 1099 Nec For Nonemployee Compensation H R Block

Get Ready For The New Form 1099 Nec Stanfield O Dell Tulsa Cpa Firm

Form 1099 Nec Requirements Deadlines And Penalties Efile360

New Irs Form 1099 Nec For Nonemployee Compensation Vero Beach Fl Accountant Kega Cpas

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

E File Irs 1099 Misc Form Online 1099 Misc Form Miscellaneous Income Is An Irs Form That Is Used To Report Non Employee Compensation In The United States Form 1099 Misc Online Is A Type Of

New Irs Form 1099 Nec Takes Non Employee Compensation Out Of Misc Tax Practice Advisor

Change To 1099 Form For Reporting Non Employee Compensation Ds B

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 Nec Released For The Filing Year Berntson Porter Company Pllc

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

1099 Nec And 1099 Misc Changes And Requirements For Property Management

1099 Nec Form Copy B Recipient Zbp Forms

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

New For Tax Form 1099 Nec Sek

1099 Nec Form Copy B Recipient Zbp Forms

Memo For 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Irs Introduces New 1099 Nec Form To Report Nonemployee Compensation

There S A New Tax Form With Some Changes For Freelancers Gig Workers

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Ready For The 1099 Nec

Form 1099 Nec Instructions And Tax Reporting Guide

How To Use The New 1099 Nec Form For Dynamic Tech Services

1099 Nec A New Way To Report Non Employee Compensation

The Return Of Irs Form 1099 Nec Stees Walker Company Llp Blog

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

New Form 1099 Nec Replaces 1099 Misc For Reporting Non Employee Compensation For Boyer Ritter Llc

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

New Form 1099 Nec Non Employee Compensation Virginia Cpa

How To Use The New 1099 Nec Form For Dynamic Tech Services

Irs Launches New Form Replacing 1099 Misc For Wicz

1099 Misc Form Copy B Recipient Discount Tax Forms

Form 1099 Nec Vs 1099 Misc For Tax Year Blog Taxbandits

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

Irs To Reinstate Form 1099 Nec Requests Comments On Draft

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Tax Statements You Need To File Your Return Don T Mess With Taxes

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Quickbooks 1099 Form Copy A 1099misc Discount Tax Forms

Irs Takes Non Employee Compensation Out Of 1099 Misc New Form 1099 Nec Cpa Practice Advisor

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

Form 1099 Nec Reporting Nonemployee Compensation Albin Randall And Bennett

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Form 1099 Nec Instructions And Tax Reporting Guide

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

Changes In 1099 Reporting For Tax Year Form 1099 Nec

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Use Form 1099 Nec To Report Non Employee Compensation In

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

1099 Nec Form Copy B C 2 3up Discount Tax Forms

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Hhm

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

What Is Form 1099 Nec

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

1099 Nec 1099 Express

Form 1099 Nec What It S Used For Priortax Blog

1099 Nec Form Copy A Federal Discount Tax Forms

Is Your Business Prepared For Form 1099 Changes Rkl Llp

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Official 1099 Forms At Lower Prices Discounttaxforms Com

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Public Documents 1099 Pro Wiki

No comments:

Post a Comment